PrimeRadiant tools stand out for their mathematical and technical depth

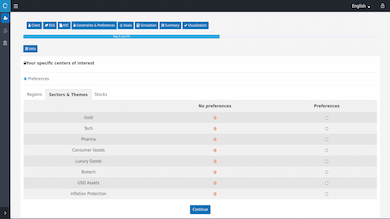

Preferences

Unlimited capacity to take into account individual options

ESG preferences, sector preferences, and any other form of preferences are taken into account. The options offered to clients are defined by you.

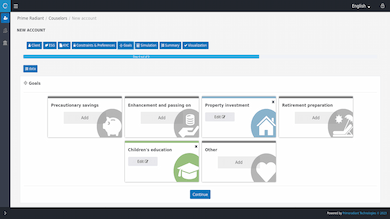

Project

Ability to develop and illustrate the management of multiple life projects

An individual inevitably has multiple objectives with different horizons, and multiple accounts (tax shelter, life insurance, retirement etc...). This complexity is difficult to manage for an advisor. With the help of the PR tool, it becomes simple.

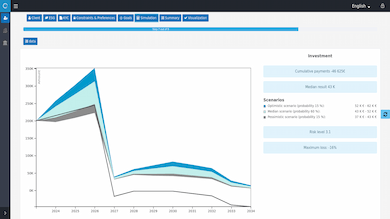

Portfolio

The construction of 'ultra-personalized' portfolios is built upon your model portfolios

Individualized portfolios are constructed for each client, within the framework of legal constraints, objectives, investment preferences, and client's risk tolerance, across all their managed accounts as a whole, taking into account their specificities.

PrimeRadiant also accompanies you for

Compliance with constraints

Successive layers of sophisticated algorithms take into account various constraints (minimum/maximum asset size, transaction size, multi-asset constraints, risk limits, etc.)

The calculation of the operations to be executed

PrimeRadiant calculates an optimal target portfolio for each client, even if they have multiple accounts, and generates order lists for each account, thereby simplifying operational processes.

You choose

The investment universe, funds, asset classes, and themes that you want to prioritize for your clients: ESG, Tech Sector, etc.

The manager who guides the allocations.